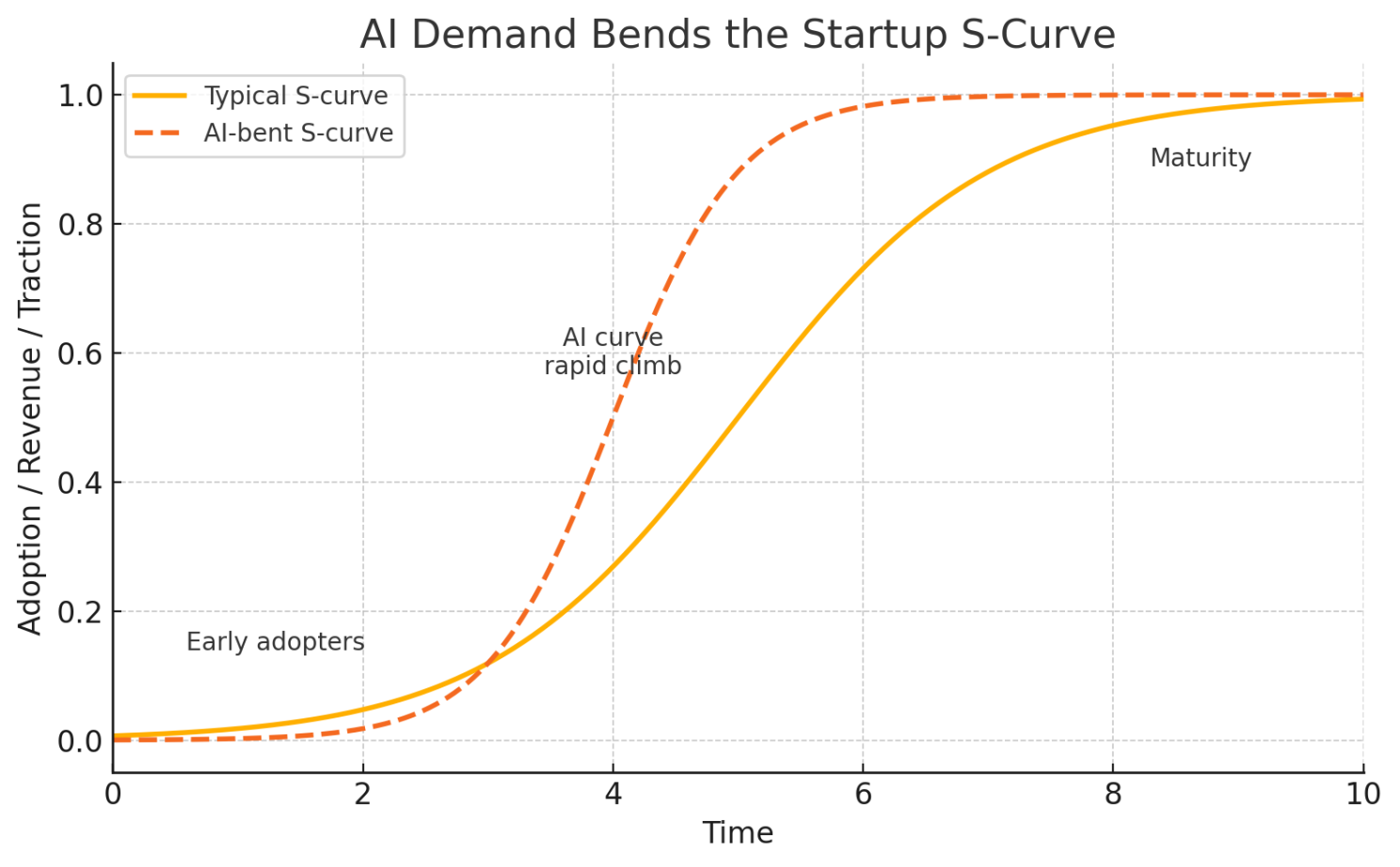

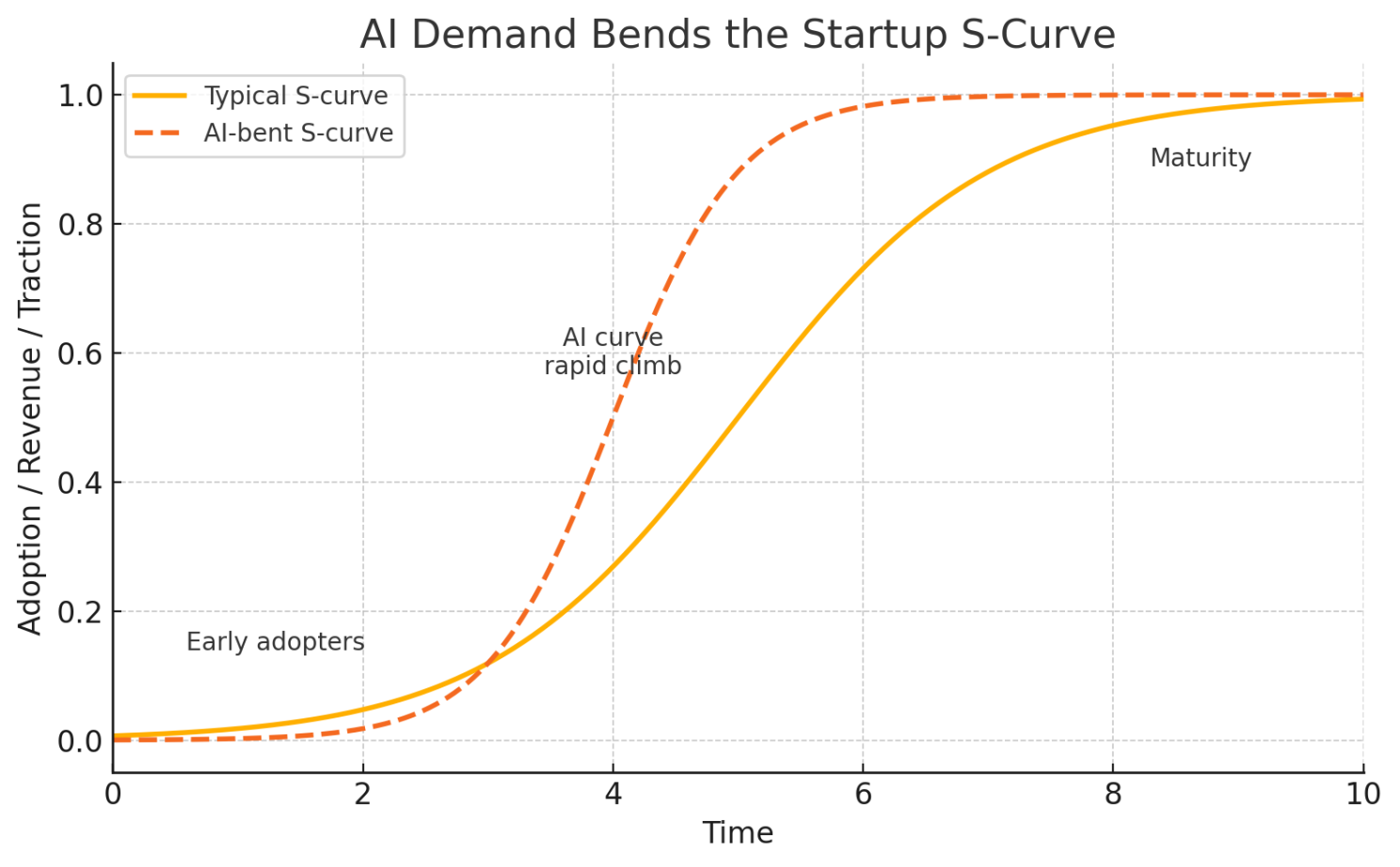

AI Demand Bends the Startup S-Curve

1. The shape of disruption is changing

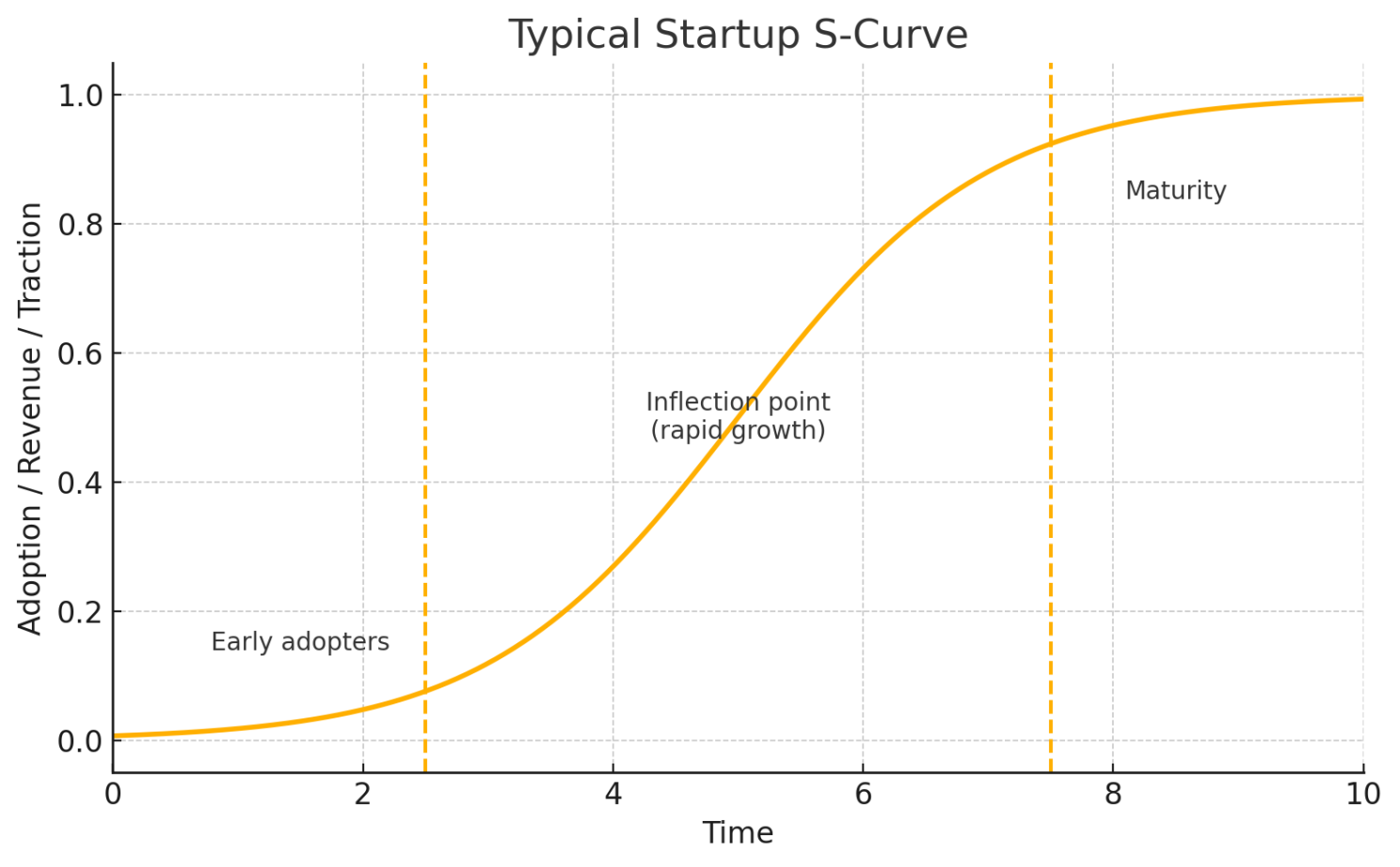

Business school charts teach us that breakthrough products follow a predictable S-curve: slow early adoption, an inflection point, then asymptotic saturation. That framework still works for microwave ovens or EVs—but generative AI is distorting it beyond recognition. The curve is compressing, tipping almost vertical in its early phase, and sometimes leaping straight to scale before analysts finish their first cohort report (Reuters).

2. A two-month sprint to 100 million users

The cleanest X-ray of this phenomenon is ChatGPT. UBS's traffic analysis showed the chatbot reached 100 million monthly active users in just two months—the fastest consumer adoption ever recorded. TikTok needed nine months to hit the same mark; Instagram, ~30 months; Spotify, 54 (Business Insider). Put differently: AI compressed the "go-to-market decade" of Web 2.0 down to eight weeks. By the time regulators started asking basic policy questions, the product had a user base larger than France.

3. Why the classic S-curve breaks under AI load

Two forces bend the curve:

- Lower friction at the point of value. Software that communicates in natural language on any device collapses onboarding friction to near-zero.

- Composability. Foundation models let builders stack new use cases like Lego bricks, so a compelling feature can become an entire platform within a quarter.

The result: adoption that behaves less like product diffusion and more like network contagion, moving at the speed of memes.

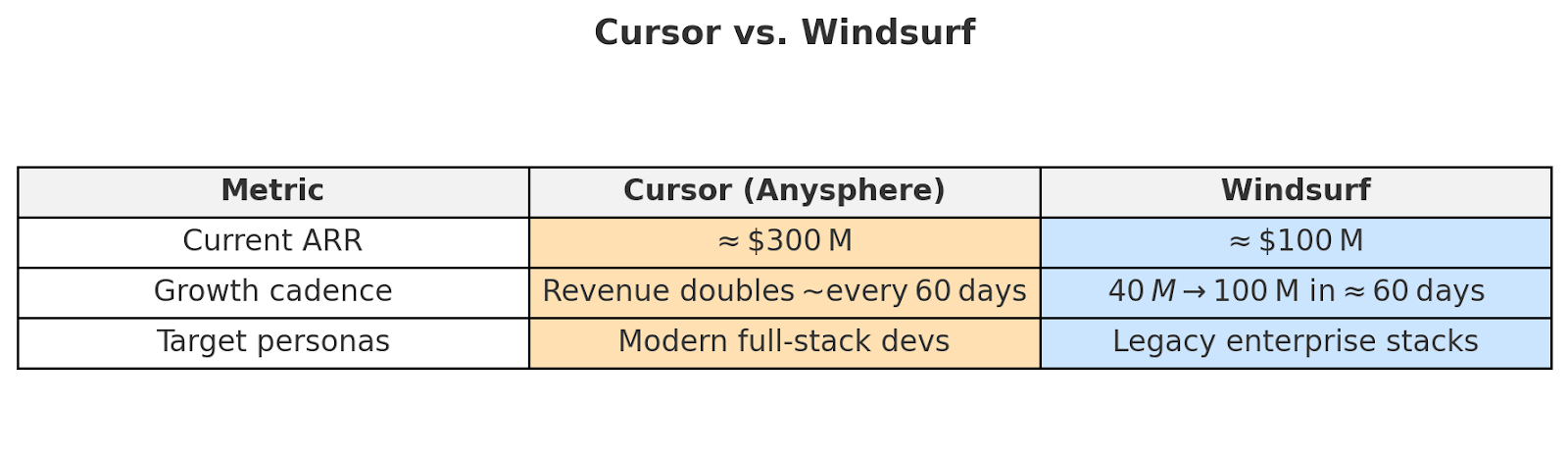

4. Cursor & Windsurf: Enterprise demand on fast-forward

Consumer virality is the headline, but the same physics are warping enterprise software:

Cursor is already chasing a $10B valuation, per Bloomberg. Windsurf fielded a $3B cash offer from OpenAI after only a year in market (Techcrunch). We used to celebrate a B2B SaaS company that added $50M in ARR in its fifth year. Windsurf did it between Valentine's Day and St. Patrick's Day.

5. OpenAI's shopping spree is the canary

Why does the world's leading AI model vendor need to buy application-layer startups instead of building clones internally?

- Path dependency. Developer mindshare compounds quickly; once a tool becomes part of the daily workflow, switching costs skyrocket.

- Competitive pressure. Anthropic, Google Gemini, and DeepSeek now beat GPT-4 on some coding benchmarks and undercut on price. OpenAI can't afford a cold start in dev-tools while rivals bundle models directly into IDEs.

- Time arbitrage. A 12-month build cycle is an eternity when adoption curves bend this hard; $3B is the cheap option.

For founders, that means strategic exit doors swing open long before the alphabet soup of late-stage rounds. For investors, it's a reminder that time-to-liquidity no longer maps to legacy funding stages.

6. The 2025-27 "AI vintage" is mis-priced

- Distribution moves at meme speed. If your GTM relies on a multi-quarter land-and-expand cadence, you're out of sync.

- Product cycles invert diligence cycles. Founders iterate faster than investors can template "pattern recognition," so pre-seed rounds can under-price category killers.

- Valuation math shifts from TAM to TAM velocity. A static $10B opportunity is less interesting than a $1B slice that grows 10× while you're building the model.

7. How Orange Collective is positioning

At Orange Collective, we invest pre-Demo Day in Y Combinator's AI-first startups precisely because the curve bends hardest at the very start:

- Proximity to the inflection. YC brings the densest cohort of AI talent on the planet under one roof twice a year; we write the first institutional checks before the market re-prices the risk.

- Playbooks for hyper-scaling. Our community has scaled companies from dorm rooms to $1B+ outcomes – we compress GTM experiments into days, not quarters.

- Optionality via network effects. Our 150+ YC alumni LP base becomes the first cohort of users, design partners, and evangelists—an unfair distribution edge when minutes matter.

8. What this means for LPs

Traditional venture diligence assumes a seven-to-ten-year fund cycle. But if exits and secondary liquidity arrive in 24–36 months, returns stack faster than capital calls. Early positioning in the right vintage = leverage on both IRR and multiple.

Two questions we hear from prospective LPs:

- "Isn't AI already crowded?" Crowded doesn't matter when the curve is vertical; penetration is still low and net-new use cases appear weekly.

- "Will big tech own everything?" Possibly at the model layer, but the application layer fragments—that's where Cursor, Windsurf, and scores of YC founders build wedge products that later become indispensable modules for incumbents (who pay handsomely).

Curious what we're backing next? Sign up to learn more about Orange Collective.